Resilient first half despite an environment disrupted by the Covid-19 crisis

HERIGE has released its results for first-half 2020. The consolidated financial statements were reviewed by the Supervisory Board at its meeting on September 4, 2020.

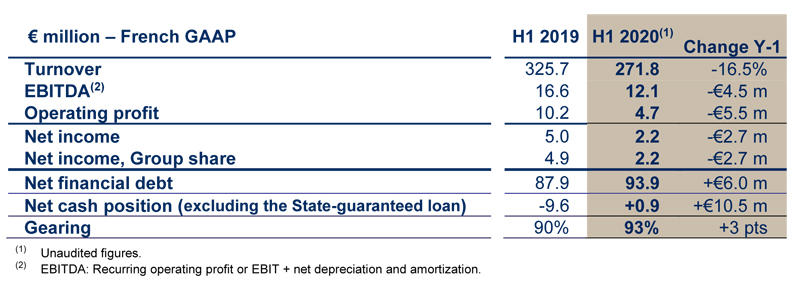

Improved gross margin rate and operating profit of €4.7 million despite a slowdown in activity

HERIGE posted turnover of €271.8 million in the first half of 2020, down 17.5% like-for-like, mainly due to the Covid-19 health crisis. After a sharp drop in business (down 37% like-for-like) in March, April and May during the confinement, the Group’s proactive sales momentum drove like-for-like growth of 13.6% in June, boosted by a catch-up effect combined with a favorable calendar effect.

In a context of decreasing volumes, the Group’s gross margin in absolute terms dropped €19.1 million like-for-like to €100.9 million (€104.4 million at current scope). However, thanks to strict management, the Group’s gross margin in percentage terms improved by 0.7 points to 38.2% of turnover (like-for-like).

As a result of the measures implemented as part of the cost reduction plan, EBITDA contracted by a moderate €4.5 million to €12.1 million.

Thanks to improved margins, the cost reduction measures quickly implemented by the Group and the rebound in activity in June, operating profit amounted to a positive €4.7 million.

After taking into account a net financial expense of €0.6 million (up €0.3 million compared with first-half 2019 thanks to effective cash management and improved interest rates), recurring income before tax stood at €4.1 million (compared with €9.3 million in first-half 2019).

Non-recurring income amounted to €0.4 million (versus non-recurring losses of €0.9 million in first-half 2019), mainly including capital gains on asset disposals.

Net profit, Group share therefore amounted to €2.2 million for first-half 2020 compared with €4.9 million for first-half 2019.

Financial position: securing the Group’s cash resources

Non-strategic investments were down at €7.5 million compared with €12.9 million at June 30, 2019, in line with the current policy of deferring such investments.

At June 30, 2020, the Group’s financial position was strengthened with shareholders’ equity of €101.5 million, positive net cash of €0.9 million (excluding the State-guaranteed loan) compared with negative net cash of €9.6 million in first-half 2019, and carefully managed net debt of €93.9 million, resulting in a net gearing ratio of 93% versus 90% for the prior-year period.

Additionally, in order to secure its resources over the long term, HERIGE obtained State-guaranteed loans for €50 million from its historic banking partners who, once again, demonstrated their full confidence in the Group’s ability to rebound.

Outlook and developments

Despite a macroeconomic and health environment that remains uncertain, the faster-than-expected pickup in business gives the Group confidence in its ability to limit the impact of the crisis on its profitability and cash position for the full year.

In these unprecedented circumstances, HERIGE Group can rely on a number of strengths, including its sound financial structure and its tried and tested ability to adapt rapidly.

NEXT PUBLICATION: Q3 2020 turnover on November 3, 2020 (after the stock exchange closes)

All our financial communications are available on our website www.groupe-herige.fr

>> Download the press release (pdf - 231 Ko)